Renters Insurance in and around Milwaukee

Looking for renters insurance in Milwaukee?

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Calling All Milwaukee Renters!

Think about all the stuff you own, from your tablet to couch to coffee maker to lamp. It adds up! These belongings could need protection too. For renters insurance with State Farm, you've come to the right place.

Looking for renters insurance in Milwaukee?

Rent wisely with insurance from State Farm

State Farm Has Options For Your Renters Insurance Needs

Renting a home is the right choice for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance may take care of damage to the structure of your rented home, but that doesn't cover the repair or replacement of your belongings. Renters insurance helps protect your personal possessions in case of the unexpected.

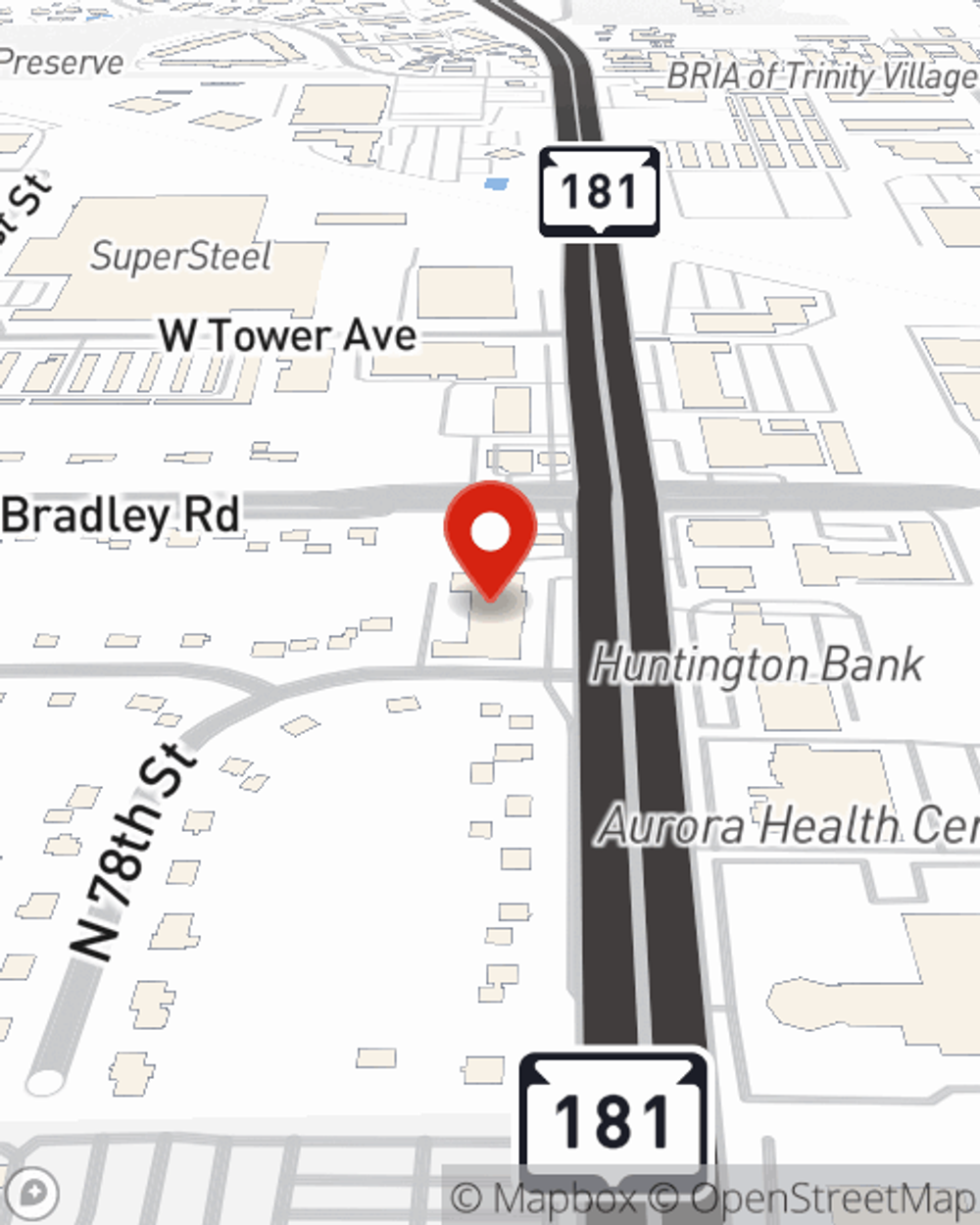

There's no better time than the present! Reach out to Karin Bojarski-Vella's office today to get started on building a policy that works for you.

Have More Questions About Renters Insurance?

Call Karin at (414) 355-1141 or visit our FAQ page.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Karin Bojarski-Vella

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.