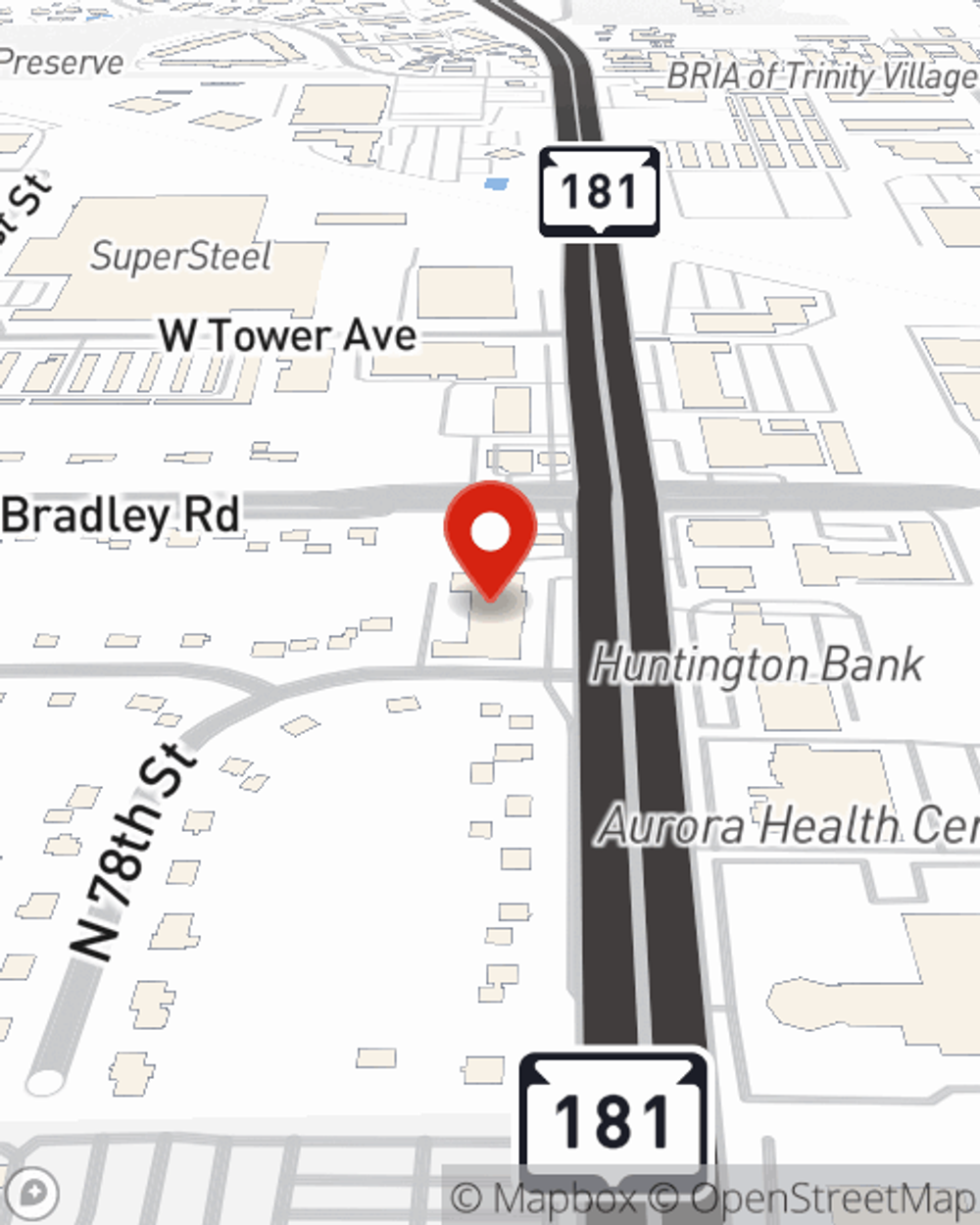

Business Insurance in and around Milwaukee

Looking for small business insurance coverage?

Insure your business, intentionally

Business Insurance At A Great Value!

Preparation is key for when the unexpected happens on your business's property like a customer slipping and falling.

Looking for small business insurance coverage?

Insure your business, intentionally

Surprisingly Great Insurance

Our business plans rarely account for every worst-case scenario. Since even your brightest plans can't predict global catastrophes or consumer demand. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for protection with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your hard work with coverage like business continuity plans and errors and omissions liability. Terrific coverage like this is why Milwaukee business owners choose State Farm insurance. State Farm agent Karin Bojarski-Vella can help design a policy for the level of coverage you have in mind. If troubles find you, Karin Bojarski-Vella can be there to help you file your claim and help your business life go right again.

Don’t let the unknown about your business keep you up at night! Reach out to State Farm agent Karin Bojarski-Vella today, and discover how you can meet your needs with State Farm small business insurance.

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Karin Bojarski-Vella

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.